安進公司(納斯達克股票代碼:AMGN)是值得擁有的高質量股票嗎?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of Amgen Inc. (NASDAQ:AMGN).

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Amgen is:

75% = US$3.8b ÷ US$5.0b (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.75.

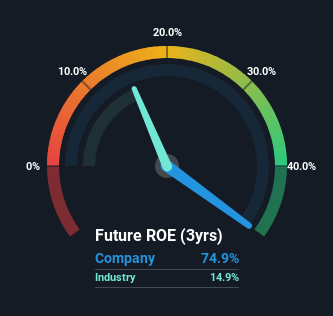

Does Amgen Have A Good ROE?

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. Pleasingly, Amgen has a superior ROE than the average (15%) in the Biotechs industry.

NasdaqGS:AMGN Return on Equity May 27th 2024

That is a good sign. With that said, a high ROE doesn't always indicate high profitability. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. Our risks dashboardshould have the 3 risks we have identified for Amgen.

The Importance Of Debt To Return On Equity

Companies usually need to invest money to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Combining Amgen's Debt And Its 75% Return On Equity

It appears that Amgen makes extensive use of debt to improve its returns, because it has an alarmingly high debt to equity ratio of 12.75. While its ROE is no doubt quite impressive, it could give a false impression about the company's returns given that its huge debt could be boosting those returns.

Conclusion

Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So you might want to check this FREE visualization of analyst forecasts for the company.

But note: Amgen may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

標簽: 納斯達克

相關文章

-

納斯達克計劃推出代幣化證券交易業務詳細閱讀

納斯達克正與美國監管機構合作,計劃推出代幣化證券交易業務。在特朗普政府放寬加密貨幣監管的背景下,代幣化熱潮持續升溫,納斯達克也由此成為華爾街最新一...

2025-09-09 20 納斯達克

-

中企赴美上市面臨變數!納斯達克擬提高中資企業IPO募資門檻詳細閱讀

納斯達克擬收緊IPO規則并加快退市流程,中國企業赴美上市前景面臨重大不確定性。智通財經APP獲悉,納斯達克集團周三宣布,擬對小型首次公開募股(IPO ...

2025-09-05 21 納斯達克

-

納斯達克中國金龍指數漲逾2%詳細閱讀

炒股就看金麒麟分析師研報,權威,專業,及時,全面,助您挖掘潛力主題機會! (來源:網易科技) 人民財訊7月15日電,納斯達克中國金龍指數漲逾2%,...

2025-07-16 44 納斯達克

-

標普500指數和納斯達克指數創歷史新高,受人工智能重燃押注及降息希望推動詳細閱讀

周五,標普 500 指數和納斯達克綜合指數創下歷史新高。在人工智能熱情重燃以及貨幣政策可能放寬的推動下,美股從持續數月的暴跌中復蘇。 基準的標...

2025-06-27 45 納斯達克

- 詳細閱讀

-

美股大幅高開,納斯達克中國金龍指數漲超1%詳細閱讀

美股大幅高開,道指漲1.57%,納指漲1.61%,標普500指數漲1.34%。納斯達克中國金龍指數漲超1%,熱門中概股方面,網易盤初漲超4%,小鵬汽車...

2025-01-16 55 納斯達克

發表評論